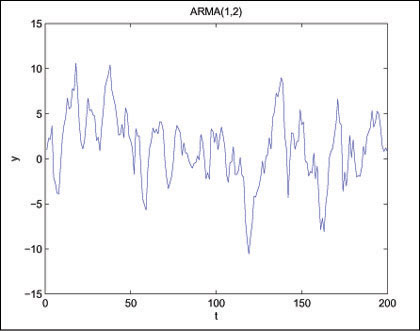

Simulation of an ARMA (autoregression moving average) model. (Image by Paul Schrimpf taken from recitation notes.)

Course Description

The course provides a survey of the theory and application of time series methods in econometrics. Topics covered will include univariate stationary and non-stationary models, vector autoregressions, frequency domain methods, models for estimation and inference in persistent time series, and structural breaks. We will cover different methods of estimation and inferences of modern dynamic stochastic general equilibrium models (DSGE): simulated method of moments, maximum likelihood and Bayesian approach. The empirical applications in the course will be drawn primarily from macroeconomics.

Recommended Citation

For any use or distribution of these materials, please cite as follows:

Anna Mikusheva, course materials for 14.384 Time Series Analysis, Fall 2007. MIT OpenCourseWare (https://ocw.mit.edu), Massachusetts Institute of Technology. Downloaded on [DD Month YYYY].